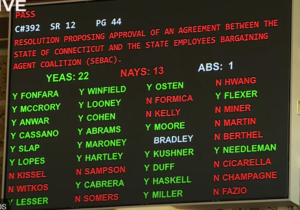

SEBAC Agreement Passes CT House and Senate

Dear Colleagues,

Today is a historic day!

After two years of negotiations, countless meetings, and many hours of debate with the UConn Health Administration and the Governor’s office, and a historic vote by the membership, our contract has been voted on by both the House (96 yes to 52 no) and in the Senate (33 yes to 1 no)!

The current contract is retroactive from July 2021 and will not only provide you with the retroactive raise and bonus you deserve but will also provide additional benefits to help you navigate your work. We are grateful that the Governor and the House and Senate have recognized your dedication and flexibility during these challenging times.

Please refer to the Contract for new proposals.

For those who haven’t joined UCHC-AAUP, the time is now! Feel free to send in the e-form and become a member today. The member sign-up form is here. Please email the signed form to Terri Reid (admin@uchc-aaup.org) at your earliest convenience.

Kind regards,

Ibrahim, Ion, and Laura